Pre Qualified vs Pre Approved

Happy December everyone, it's the Holiday Season but don't forget it's never a bad time to start looking and specially start understanding the home buying process😁

Pre-Qualification vs. Pre-Approval: What’s the Difference?

When you initially set out to purchase a new home, the real estate agent and home seller will want to know you can actually afford the thing. Heck, you should want to know too.

After all, if you can’t afford to buy it, you’ll be wasting everyone’s time, including your own. Aside from affordability concerns, you may find other issues that disqualify you from obtaining a mortgage.

And these issues aren’t always obvious, especially to the first-time home buyer who has never obtained a home loan before.

When you begin the process of buying a home, you may come across new words and phrases that may be unfamiliar to you. In today’s competitive housing market, it is important to be knowledgeable about certain real estate terms to help put yourself in the best purchasing position possible.

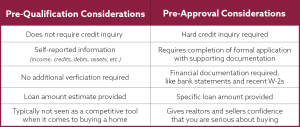

As you prepare to apply for a mortgage, you will come across terms like “pre-qualification” and “pre-approval.” What is the difference between these two documents? Simply answered, one is silver and one is gold. Although they sound similar, only the pre-approval will get realtors and sellers to take you seriously. Let’s take a closer look:

Pre-qualification: Typically, a pre-qualification is an unverified, informal analysis of your financial picture to determine how much you can afford to pay for a home. It’s based on information that you provide about your credit, debt, income, and assets, without officially going through a formal application process. Based on your overall financial picture, the lender can estimate how much you may be able to qualify for. Getting pre-qualified can give you an idea of your financial readiness along with different mortgage options to consider as you begin exploring a home purchase.

Pre-approval: While a pre-qualification can be a helpful tool in the beginning stages of the lending process, a pre-approval is crucial when you are ready to take the home buying process to the next level. It requires a formal application with proof of your financial history and stability. The lender will request documents to verify your income, assets, & debt and will also request your credit report. If you meet the requirements of obtaining a mortgage, you will receive a pre-approval letter that will state the amount and type of mortgage the lender is willing to offer, along with terms and any conditions. Real estate agents and sellers will want to see the pre-approval letter before showing and accepting an offer on a property.

When it comes down to it, an approval is never a sure thing until the mortgage is funded and closed!

Also don't forget your Real Estate agent has worked with a lot of different lenders and banks over the course of their careers... Ask us for recommendations, that's why we are here.

Depending on the situation and the location we will know who would be best for you to call.

It's always good to try a few different lenders or banks to see what they can offer you and who you would like to work with.

Trust a professional, trust us, it's worth it!!

Because we care...

#teambousehouse

#ocrealestate #remax

Comments

Post a Comment